Carrousel - Noticias secundarias 1

La UCM, categoría QS 5 STARS

Prepara tu entrevista de trabajo practicando con un avatar

Carrousel - Noticias secundarias 2

¡Inscríbete!

Apertura extraordinaria de la Biblioteca María Zambrano

Noticias

Agenda

-

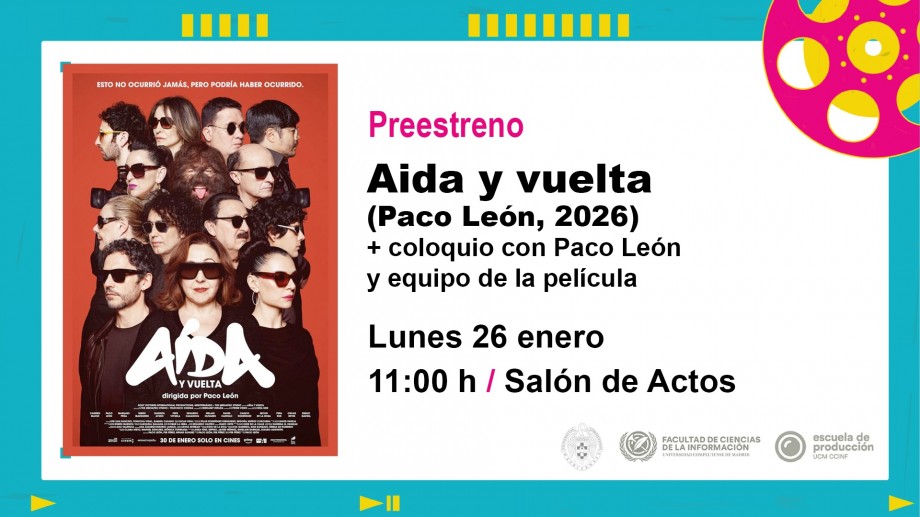

26 enero

-

27 enero

-

28 enero

-

28 enero

-

29 enero

-

03 febrero

-

05 febrero

-

11 febrero

-

10 marzo

Estudia con nosotros

Cultura Complutense

Investigación UCM

Deporte UCM

Recursos

Imagen destacada

Competiciones deportivas

Destacados

Unidad de Cultura Científica UCM

Complutense Saludable

Fundación Complutense

Más Destacados

- Elecciones a representantes de los Sectores de Resto de Personal Docente e Investigador, Estudiantes y Personal Técnico, de Gestión y de Administración y Servicios en Consejo de Departamento

- Elecciones a representantes del Sector de Estudiantes en Consejo de Departamento

- Elecciones a representantes de los Profesores Asociados de Ciencias de la Salud en Consejo de Departamento

- Acceso remoto a servicios

- Certificados de Retenciones IRPF